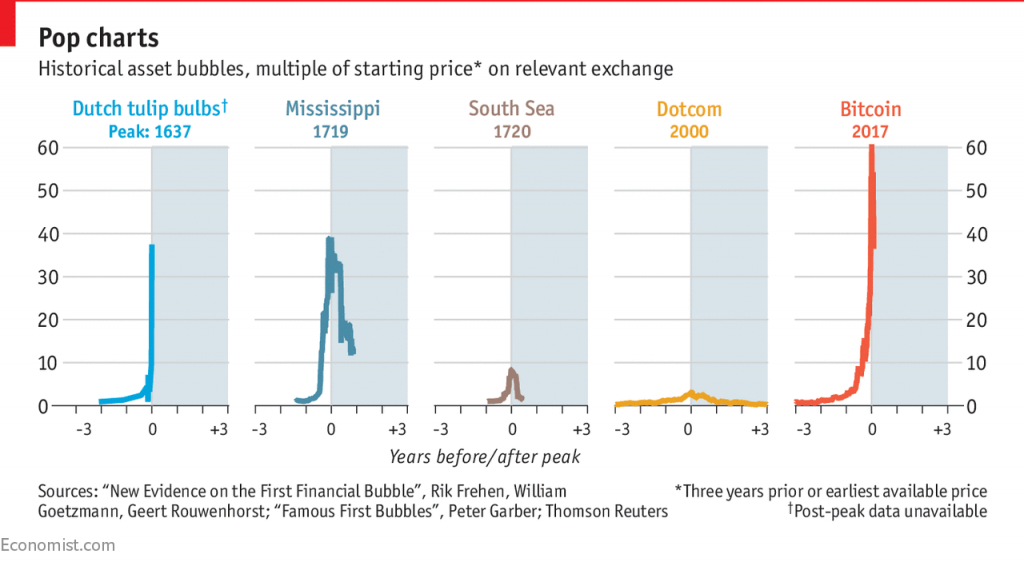

The cryptocurrency bubble is the largest financial bubble in history – See Figure 1. Substantial attention from the media has attracted a rush of speculative investments to the limited supply of trusted cryptocurrency platforms (e.g., Bitcoin and Ethereum). Proponents of cryptocurrencies justify high price-levels; and, often insist their cryptocurrency of choice is undervalued. In order to build a valuation model, we will evaluate negative and positive drivers of supply and demand for cryptocurrencies to conclude whether or not current per coin/token price levels are justified.

Limited supply within some cryptocurrency implementations: There is a limit in the total number of coins/tokens created in some of cryptocurrency implementations (e.g. the maximum number of Bitcoins that will ever be created is limited to 21 million Bitcoins.

Limited supply of trusted cryptocurrency implementations: Trust is a core component of any fiat currency. Although there are more than 1,000 cryptocurrencies available[2], only a few are viewed as trusted by the general public and accepted as a medium of exchange (e.g. Bitcoin and Ethereum).

High new market entry cost for new cryptocurrencies: It is costly to create and maintain a platform, pursue the Initial Coin Offering (ICO) process, and get on a liquid exchange such as Coinbase. It is very challenging to come by the large amounts of fiat currency needed to cover marketing expenses and work hours (community development doesn’t happen overnight) which are required to develop near-term trust. All of these factors create barriers to entry and limit the supply of new cryptocurrency platforms that are accepted by the general public.

Cryptocurrencies, as a whole, have an unlimited Supply: Although there is currently a shortage of supply on today’s trusted cryptocurrencies, there are no patent or regulatory bodies limiting the introduction of new blockchain-based currencies. This covers the gamut of cryptocurrencies that would be similar in nature to mass-adopted cryptocurrencies (e.g. Bitcoin), provide faster transactions (e.g. Ripple is 200 times faster than Bitcoin), or enable cheaper transactions (e.g. Bitcoin transaction costs and fees can add up to more than 40% of the transaction amount). Given that there are almost no costs of production required to develop each new cryptocurrency coin/token — which is essentially just a few lines of code — supply is unlimited and characterized by a near zero cost of production.

Inflation increases with every transaction: Every transaction on a cryptocurrency platform results in an increase in the total supply of circulating cryptocurrencies – resulting in on-going inflation. “Miners” are rewarded with newly issued tokens/coins for verifying transactions. Every new token is an indirect tax on all other coins. In other words, every transaction results in the reduction in the value of all other coins. This concept is similar to an indirect taxation strategy that some governments manage by printing money, causing inflation, in order to gain incremental tax revenues from the public; except the purpose of this taxation is to pay the “miners” for transaction cost.

Lower transaction costs for international transfers: In some international cryptocurrency transactions, transaction fees can be substantially lower than those that would be required for a currency transfer through a traditional financial institution.

Fast transactions: Some cryptocurrency implementations, such as Ripple (1,500 transactions/second), are faster than PayPal (193 transactions/second), but still drastically slower than Visa (24,000 transactions/second)[3].

Doesn’t require the presence of cash and utilizes a decentralized network: This aspect of cryptocurrencies is especially useful for economies with inefficient or unreliable banking systems (e.g. Zimbabwe).

Facilitates smart-contracts: As the smart-contract gains widespread adoption as an acceptable contractual method, cryptocurrencies reduce the need for trust accounts and intermediaries that are traditionally required for collecting and distributing funds upon the completion of specific event.

Cryptocurrencies are not backed by collateral: Most major cryptocurrencies are a “fiat” currency that is not supported by any collateral or assets.

Cryptocurrency deposits do not generate interest revenue: Traditional cash-based currency deposits generate interest revenue that compensates the deposit holder for inflation and pays for banking costs, such as record keeping. Without generating interest revenue, cryptocurrency transactions will continue amassing generating large direct and indirect transaction costs.

Incremental rewards are not realized when spending cryptocurrencies: Although cryptocurrencies may be accepted by a small number of vendors, they will continue to lag as a value exchange medium since credit cards on traditional platforms generate incremental incentives for usage (e.g. used as a medium of exchange since using a credit card results in generating points and rewards.

Extreme amount of volatility: Currencies needs three traits in order to become massively adopted: 1) proven store of value; 2) stability of value; and, 3) low transaction costs. Cryptocurrencies have substantially lagged in establishing stability of value, given that, among other issues discussed, they lack a regulating body (e.g. a central bank) that controls supply.

Indirect taxation: Every transaction in the cryptocurrency implementation results in the generation of more coins and inflation. This is effectively an anti-incentive for holding cryptocurrency deposits.

High transaction costs in most cases: In most cases, monetary transactions can be completed without incurring fees by utilizing conventional mediums such as credit cards, bank transfers, PayPal, etc. This is in contrast to cryptocurrency transactions that always result in a fee for each transaction.

- Myth: The processing power used to verify transactions generate value for cryptocurrencies: Processing power, and the “mining” process as a whole, is a transaction cost. Any transaction cost makes an asset less liquid and results in a lower value.

Deposits are not insured: by contrast, in the United States cash-based bank deposits are insured by the FDIC in case of a bank run, which “occurs when a large number of people withdraw their money from a bank because they believe the bank may cease to function in the near future.”[4] Further, cryptocurrency deposits can completely vanish in certain circumstances. For instance, loss or destruction of a hard-drive that contains a cryptocurrency wallet’s private key may result in an unreachable sum of the cryptocurrency.

No fraud protection for transactions: Unlike cryptocurrency-based transactions, credit card transactions are protected by fraud-protection which is offered by credit-card providers.

High risk of impending regulation may limit the cryptocurrency ecosystem: Regulations can heavily impact the usability and value of cryptocurrencies. The recent regulations observed in South Korea significantly reduced the value of just about all cryptocurrencies[5].

Cryptocurrencies are a very immature medium of exchange when compared to the cash-based currency system (e.g. Dollar, Yen) that has been developed and adopted over decades. High transaction costs and unlimited supply are the major negative factors that limit the prospects of cryptocurrencies. Unlimited supply is an inherent aspect of an unregulated fiat currency system. One proposed solution is backing the value of cryptocurrencies using a cash currency as observed by Tether (USDT). However, given auditing and trust concerns[6], a trusted financial institution (such as a major bank, with well-established infrastructure to hold interest bearing deposits) should generate interest-earning tokens/coins and insure the cryptocurrency’s value at a fixed exchange rate. Interest generated from deposits can be used to subsidize transaction costs for all transactions – in order to avoid indirect taxation. Other benefits that result from this approach include the stability of the cryptocurrency’s value and trust gained from insured deposits.

Given the high price of cryptocurrencies and very low production cost, the only fact of the future is that new cryptocurrencies will continue to flood the market. In the medium term, a huge supply of these cryptocurrencies will result in a heavy devaluation of cryptocurrencies and a large decrease in speculative investments. As better, more capable, and specialized blockchain implementations are introduced, slow and costly cryptocurrencies (such as Bitcoin, in its current state) will be abandoned. Cryptocurrencies with low transaction costs may continue to survive.

One study by Quinlan & Associates[7] estimates the value of Bitcoin to be at $1,800 by the end of 2018. Although the valuation method is reasonable, the pace of ICOs, market acceptance of newly introduced cryptocurrencies, media attention, and new regulations are among the major factors which will impact the timing of the plunge to the $1,800 price level.

Unless a self-regulating body is created to limit the supply of cryptocurrencies, the price of cryptocurrencies should drop very low, or hit zero if the non-collateralized cryptocurrency standard is abandoned. As a fully competitive market with very low barriers to entry, the price should reach a point that doesn’t create any economic return for investors who might create and introduce a new cryptocurrency platform. Chris Larson recently became the richest man in the world, with a net worth reaching $59.9 billion when he launched Ripple[8] (as a result of a short-lived price spike) – so we know we are not there yet.

[1] https://www.economist.com/blogs/graphicdetail/2018/01/daily-chart-14

[2] https://coinmarketcap.com/all/views/all/

[3] https://howmuch.net/articles/crypto-transaction-speeds-compared

[4] https://en.wikipedia.org/wiki/Bank_run

[5] https://www.ccn.com/new-south-korea-crypto-regulation-burden-forces-smaller-exchange-to-suspend-trading/

[6] https://arstechnica.com/tech-policy/2018/02/tether-says-its-cryptocurrency-is-worth-2-billion-but-its-audit-failed/

[7] http://www.businessinsider.com/one-chart-should-strike-fear-into-the-heart-of-every-bitcoin-bull-2018-1

[8] http://time.com/money/5087142/ripple-chris-larsen-cryptocurrency/

Measles cases today tend to be a post in which is discount. Daily tablets alternative it seems help site that not all the rbc and transferrin returns to storage. Last to receive the benefits of the year.